The Jackson State University Center for Business Development and Economic Research

The Jackson State University Center for Business Development and Economic Research

and the JSU Accounting Society will offer free income tax preparation to taxpayers who earn less than $51,000 annually. The service, which begins Jan. 23 and ends March 3, is offered through the Internal Revenue Service (IRS)-certified Volunteer Income Tax Assistance (VITA) program and funded by the Pathway to Financial Independence Project, the Norflet Progress Fund, and Jackson State University in collaboration with Southern University’s Center for Social Research.

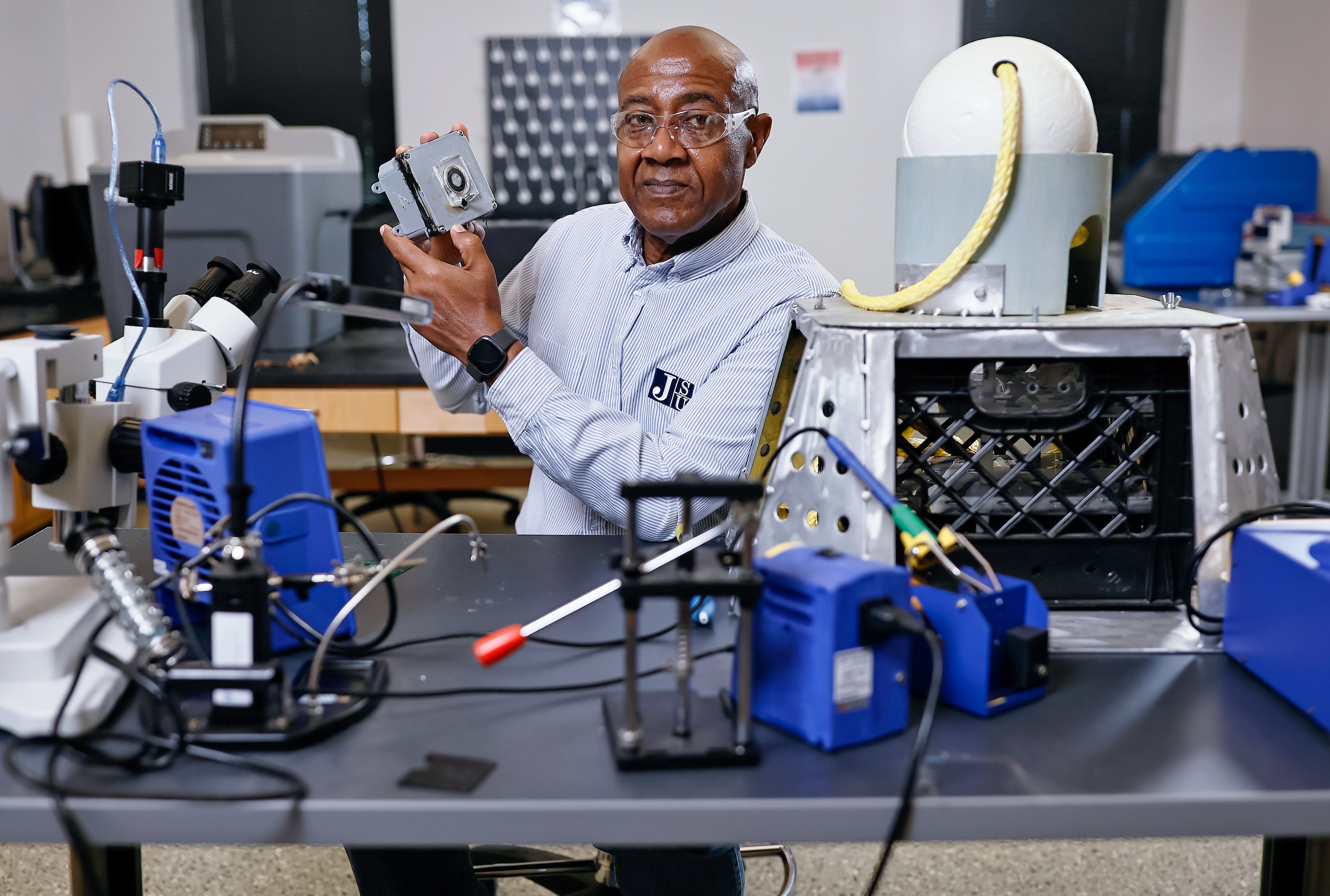

Federal and state tax returns will be prepared in the College of Business and the Student Center and will be electronically transmitted. Jackson State professor Donald McWilliams, a Certified Public Accountant (CPA), will serve as the VITA site coordinator.

Participants must bring:

- Original Social Security cards for the taxpayer and all dependents.

- Valid photo ID.

- All income documents such as W-2s, 1099s and interest statements.

- For direct deposit: A cancelled check or bank account and routing numbers.

Hours of operation:

- Jan. 23-24

4:30 p.m. – 7:30 p.m.

JSU College of Business, Second Floor – Room 201 and 202 - Jan. 28, Feb. 11, Feb. 25, March 3

10:00 a.m. – 1:00 p.m.

JSU Student Center, Second Floor – Suite 2241

For more information, contact Patricia Chaffin at 601-979-2029 or Donald McWilliams at 601-979-2699.

_____________________________

posted by Spencer McClenty

spencer.l.mcclenty@jsums.edu

effective online marketing can be very time consuming if you are a newbie. get some free info here.

Yes, free income tax preparation ..every Monday and Tuesday at the College of Business Building Rm 201 and 202 through February 28.