[hr]

![]()

[hr]

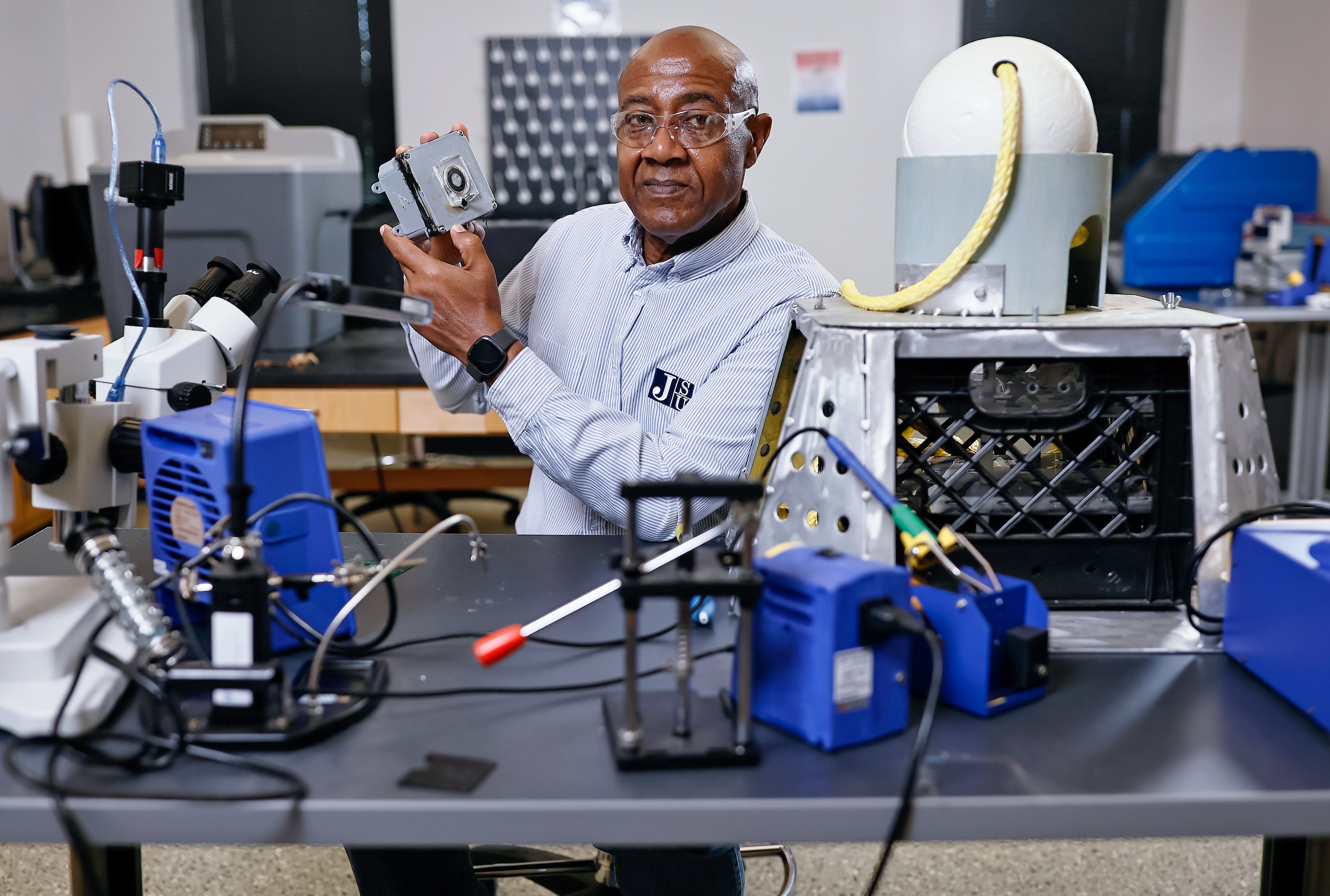

In 2009, JSU accounting instructor Donald McWilliams brought an IRS sponsored tax preparation program to Jackson State’s campus. McWilliams is a certified public accountant and site coordinator for VITA at JSU that has helped hundreds of low-to-middle income filers.

The goal is to provide free basic tax return preparation for those making $52,000 or less. This initiative also helps people with disabilities, the elderly, and those with limited English proficiencies preventing them from successfully filing their own tax returns.

“We provide services to everyone that qualifies and since we are here at Jackson State, we do make the program available to faculty, staff, students and people in our community as well,” said McWilliams.

Prior to joining JSU, McWilliams worked for the Mississippi Department of Revenue as a criminal investigator. One of his responsibilities included investigating individuals who had committed tax preparation fraud or identity theft.

“When the IRS switched to electronic filing, they didn’t have safeguards in place to double check the information so a lot people were stealing the social security numbers of adults and children. Once they had the information in their possession, they sold it to others or filed false tax returns themselves.”

The JSU accounting professor says his experiences at the Mississippi Department of Revenue prompted him to want to help disadvantaged people in the community with their tax preparations to avoid identity theft.

“Identity theft is awful for the victim because usually these people need their refund money, and once their identity has been stolen, it takes so much to prove that they are the real person. This greatly delays their refund and is an overall hassle for everyone involved,” said McWilliams.

In 1971, Gary Iskowitz at California State University Northridge created the free VITA tax preparation program. It is now a national initiative.

Similar to Iskowitz, McWilliams says he brought VITA to Jackson State’s campus to give students an opportunity to receive professional hands-on training in tax preparation. Students who receive VITA experience can utilize it as a form of professional development for future employment opportunities and fulfill the need for community service hours at JSU.

William Tadley, a senior accounting and business administration major who volunteers for VITA said, “The experience that I have gained at JSU helping people file their tax return is incredible. It brings me so much joy to see how grateful my clients are when they are owed a refund by the IRS.”

McWilliams says his accounting students are IRS-certified participants who have taken his income-tax accounting course and completed the tax software training.

“My accounting students have to learn the tax laws and how to properly apply them using the software. The tax law is complex, and it can be intimidating to people who are not as learned as my students and I. It’s rewarding for us to help low-income people get quality tax preparation, and these people do appreciate the sacrifice our students make because they know how to properly complete tax returns.”

To ensure accuracy, McWilliams does a quality check after each student prepares a tax return. All students who participate in the VITA program receive certificates from the IRS recognizing their efforts.

The 2016 statistics for the JSU VITA program include:

- Trained and certified more than 33 students

- Processed 200 tax returns

- Refunds totaled more than $321,000

- Assisted 15 international students with tax returns

- Provided 40 hours and $16,000 of free service

This year, Entergy Mississippi provided paper and ink to help offset the cost for the university.

The VITA program at JSU is available each Tuesday through March 27 in the College of Business building, Suites 200 and 201. For additional information contact, Donald McWilliams at Donald.mcwilliams@jsums.edu or 601.979.2699.